Check out our latest podcast featuring JID Investments’ Founder and COO, John Rubino. In this podcast, John meets with Cheree Warrick from SimplyFunded.com to discuss passive real estate investing, to include syndications and more. You can listen to the full podcast at

JID Investments’ Founder and COO was recently featured in a Street Smart Success podcast hosted by Roger Becker. In this episode, John discusses JID’s strategy for reducing investor risk through proper due diligence while still ensuring maximum returns in a very challenging market. You can listen to the full podcast here:

JID Investments’ very own Founder and COO, John Rubino was recently featured in an article hosted by Startup Veteran, an organization focused on telling the stories of veteran entrepreneurs. In this feature article, you can read all about John’s inspiring journey from 20-year Naval aviator to business owner of a $40-million private equity real estate investment company. We hope you enjoy the article and if you would like more information on JID Investments, please feel free to contact us!

JID Investments is pleased to present our seven-part webinar series on passive real estate investing. In this series, JID founder and COO, John Rubino provides a fantastic overview of the key aspects to consider when investing passively in real estate development. projects.

Series Part I – Forming the Right Team

Series Part II – Sponsors/Developers

Series Part III – Location Location Location

Series Part IV – Types of Real Estate Development Projects for Investment

Series Part V – The Capital Stack

Pat VI – Due Diligence

Part VII – The Waterfall

All episodes can be viewed on YouTube at: https://youtube.com/playlist?list=PL5EsgKk_SA2rmgqsjdCnFBW2FPELGeilO&si=PATc5mLXTvuleJky

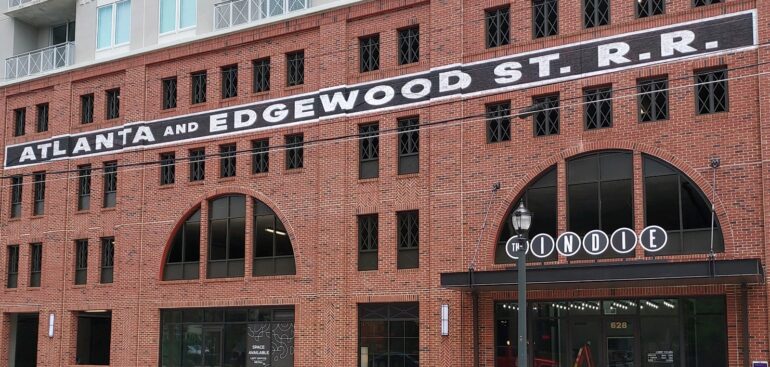

JID Investments’ Founder and COO, John Rubino and CFO David Shatz along with several investors joined Capital City Real Estate this week for two events in Atlanta, GA spotlighting two major project investments. The first event provided JIDI investors with a private tour of The Roycraft, a 42-unit residential condo development in the Virginia Highlands neighborhood. The tour was followed by a cocktail reception. The second event was the grand opening of The Indie, a 76-unit residential apartment development in the Old Fourth Ward neighborhood. Both events were very well received and provided investors with a first-hand look at two major development projects in Atlanta. Both projects are expected to be completed by late 3rd Quarter 2023.

- Open to Accredited Investors;

- Available for investment now through December 2022 (and possibly longer);

- Funds invested must be realized capital gains from prior investments or transactions (within the past 180 days);

- Taxes on invested original capital gains will be deferred until 2026 tax year;

- Tax deductions flow through to investors each year throughout the investment, and

- Opportunity Zone (OZ) investment gains are tax free once held for 10 years (on federal and most states).

JID Investments LLC (JIDI), in a joint partnership with a very experienced Columbus, Ohio Developer/Sponsor will initially invest in a residential apartment complex and single-family home in Columbus, Ohio. The property is expected to include 42 one/two-bedroom apartments and a single-family home located just a few blocks from the thriving Columbus downtown with easy access to restaurants, shopping, The Ohio State University, and major highways. The complete Summary of Investments is currently available and has been shared with JIDI Accredited Investors. The Private Placement Memorandum (PPM) package will be available for review on or about June 21st. This is JIDI’s second Qualified Opportunity Zone Fund.

JIDI anticipates future net rental profits to result in quarterly distributions as the property stabilizes as well as the potential of a refinance or recapitalization, which would provide the return of a portion of investor investment capital. This return of capital may be utilized to pay the deferred tax due on initial investment capital gains for investor’s 2026 tax return.

Investment Details:

Project Name: JIDI Opportunity Zone Fund LLC

Location (City/State): Columbus, OH (and additional TBD locations)

Project Type: Residential

JIDI Raise Amount: up to $10,000,000

Investment Unit Dollar Amount*: $5,000 (2,000 total units)*

Investment Commitment Date**: June 1, 2022, through December 31, 2022**

Date Investment Funds Due: Upon approval of Subscription Agreement and AI Verification

Length of Project/Investment: 10 years

JIDI Projected Investor Returns: 10 – 12% (includes an 8% preferred return) tax free***

JIDI Investor Equity Multiple: 2.0 – 2.2x****

* Commitments on a first come first served basis, until fully funded. Minimum investment is $20,000 (4 units).

** Or a later date as applicable.

*** Effective after-tax adjusted IRR will be as much as 4% greater. Be advised some states are non-conforming to the OZ program and require state (not federal) taxes to be paid on gains earned.

**** Equity multiple range based on various timelines, projected cashflow distributions and final profit results.

Additional benefits include:

- deferral of tax due through tax year 2026;

- reduction of overall taxes based on OZ tax-free benefit if held for at least 10 years, and

- taxpayers will receive depreciation deductions passed through in their annual k-1 statements resulting in tax savings on their personal returns. This depreciation does NOT need to be recaptured at time of assets sales.

JIDI is currently reviewing additional OZ investment opportunities that may be included in this fund at a later date. We will provide information on those as it becomes available. For more information, you can also visit the Opportunity Zone page on our website: www.jidinvestments.com/opportunityzone

For non-JIDI accredited investors who would like to participate, you can access our Accredited Investor Questionnaire (AIQ) here: (https://jidinvestments.com/services/investment-services/). The document can also be sent to you via DocuSign. Once completed and approved, JIDI will be happy to send you the Investment Summary and full project PPM package as well as all future offerings and communications. See more at www.jidinvestments.com.

We believe this investment will provide investors compelling tax-free returns over the project timeline. We welcome your questions and comments and look forward to speaking with you.

JID Investments is proud to partner with Advice Chasers to present a free educational event intended to inform and educate physicians and other medical professionals on multi-family syndication. This passive style of real estate investing can provide a lucrative and beneficial alternative to having to actively manage a real estate investment while also adding diversity to your investment portfolio. Please check out the one-hour webinar at https://advicechaser.com/blog/webinar-recording-investing-in-syndicated-multifamily-properties-for-physicians/. We hope you enjoy the presentation and please reach out to us for more information!

Thank you to Mark Seither and the Advice Chasers’ team for hosting us on your webinar. It was great sharing with you our experiences and insights regarding real estate investment and syndication. Check out the full podcast at https://advicechaser.com/blog/webinar-recording-investing-in-syndicated-multifamily-properties-for-pilots/

What is a Qualified Opportunity Zone?

A Qualified Opportunity Zone (QOZ) is an economically distressed community where new investments, under certain conditions, may be eligible for favored tax treatment. Localities qualify as QOZs if they have been nominated for designation by a state, the District of Columbia, or a U.S. territory and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation of authority to the Internal Revenue Service. QOZs were included in the tax code by the Tax Cuts and Jobs Act on December 22, 2017.

What is a Qualified Opportunity Zone Fund?

A Qualified Opportunity Zone Fund (QOF) is an investment vehicle that files either a partnership or corporate federal income tax return and is organized for the purpose of investing in QOZ property.

What types of gains are eligible for deferral if invested in a QOF?

Gains that may be deferred are called “eligible gains.” They include both short-term and long-term capital gains and qualified 1231 gains, but only gains that would be recognized for federal income tax purposes before January 1, 2027, and that are not from a transaction with a related person. For you to obtain this deferral, the amount of the eligible gain must be timely invested in a QOF in exchange for an equity interest in the QOF (qualifying investment). Once you have done this, you can claim the deferral on your federal income tax return for the taxable year in which the gain would be recognized if you do not defer it.

This Opportunity Zone Investment’s main features include:

- Open to Accredited Investors only on a first come first served basis, minimum investment is $20,000

- Funds invested must be realized capital gains from prior investments or transactions within the past six months;

- Taxes on invested original capital gains will be deferred until 2026 tax year

- Tax deductions flow through to investors each year throughout the investment, and

- OZ investment gains are tax free once held for 10 years.

Additional Benefits Include:

- Deferral of tax due through tax year 2026

- Taxpayers will receive depreciation deductions passed through in their annual k-1 statements resulting in tax savings on their personal returns. This depreciation does NOT need to be recaptured at time of assets sale if sale occurs at Year 10.

For non-JIDI accredited investors who would like to participate, you can access Accredited Investor Questionnaire (AIQ) by clicking here or request a DocuSign copy by e-mailing David Rutherford at [email protected]. Once investors complete the AIQ and JIDI approves it, they will be sent the Private Placement Memorandum package plus all future offerings and communications.

Useful Links

JID Investments: www.jidinvestments.com

Internal Revenue Service:

https://www.irs.gov/credits-deductions/opportunity-zones-frequently-asked-questions

JID Investments founder and COO, John Rubino was featured for a second time on a recent Real Estate (Un)Success Stories podcast with with Cody Lewis where they discuss the importance of communication and the art of building and maintaining relationships with investors. Check out the following iTunes link: https://podcasts.apple.com/us/podcast/the-importance-of-relationships-with-john-rubino/id1567235916?i=1000529493070